The world’s biggest steel maker just lost $7.9 billion

Another day, another two scalps for the commodity price crash.

Two huge resources firms reported results on Friday, and you can add both to the pile of giants getting crushed by the falling price of raw materials.

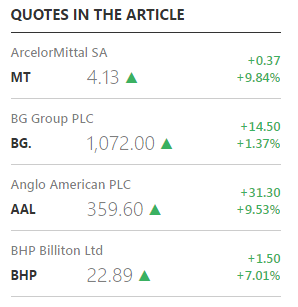

ArcelorMittal, the world's biggest steelmaker, and BG Group, the FTSE 100-listed oil giant, both took big hits last year, according to financial results released on Friday morning.

Let's start with Arcelormittal, the Dutch listed steel giant. Arcelor — whose boss Lakshmi Mittal was once the 6th richest man on earth — took an enormous loss of $7.9 billion (£5.4 million) in 2015, as the price of iron ore, a key component in making steel, continued to tank last year. The company is also trying to raise a whopping $3 billion (£2.06 billion) to deal with debt. The price of iron ore — a key ingredient in steel — fell by nearly 40% over the course of 2015.

Here are some of the key takeaways from Arcelor's results:

The loss included $4.8 billion (£3.3 billion) of writedowns, and $1.4 billion (£960 million) of exceptional charges in the company's steel business;

2015's loss was more than four times the $1.86 billion (£1.28 billion) loss which hit the company in 2014;

Debts stand at $15.7 billion (£10.8 billion), down by $1.1 billion (£760 million). That's the lowest level since Mittal Steel and Arcelor merged in 2006;

ArcelorMittal will issue $3 billion of new shares in an attempt to further reduce debts further;

Earnings fell 18.4% in the final quarter of 2015, down to $1.1 billion;

Steel shipments fell by 0.6% over the course of 2015.

Speaking about the results, Mittal said (emphasis ours):

2015 was a very difficult year for the steel and mining industries. Although demand in our core markets remained strong, prices deteriorated significantly during the year as a result of excess capacity in China.

Regrettably we have announced a disappointing net loss which includes non-cash impairment charges on our mining assets as a result of the very considerable fall in the iron-ore price. Our mining business is fully focused on adapting to this low price environment and has reduced cash costs by 20% compared with an initial target of 15%. A further 10% is targeted for 2016.

BG Group books a massive loss

Политика конфиденциальности | Правила пользования сайтом