EU referendum: Pound hits lowest level since 1985

The value of the pound has fallen dramatically as it emerged that the UK had voted to leave the EU.

At one stage, the currency hit $1.3305, a fall of more than 10% and a low not seen since 1985.

The Bank of England said it was "monitoring developments closely" and would take "all necessary steps" to support monetary stability.

Oil prices have also fallen sharply in the wake of the referendum outcome, with Brent crude down 5.2%.

The price of Brent crude fell by $2.68 to $48.24 a barrel, its biggest fall since February. At the same time, US crude was down 5.4%, or $2.69, to $47.52 a barrel.'Once-in-a-lifetime moves'

Before the results started to come in, the pound had risen as high as $1.50, as traders bet on a Remain victory.

But following early strong Leave votes in north-east England, it tumbled to $1.43 and then took another dive after 03:00 BST as Leave maintained its lead.

The move in sterling is the biggest one-day fall ever seen and London's main share index, the FTSE 100, is expected to open sharply lower, with indications of a fall of about 7%.

A weaker pound buys fewer dollars or other foreign currencies, which makes it more expensive to buy products from abroad. However, it should benefit exporters as it makes their goods cheaper abroad.

Against the euro, the pound dropped 7% to about €1.2085.

The euro also fell 3.3% against the dollar, its biggest one-day fall since the currency's inception.

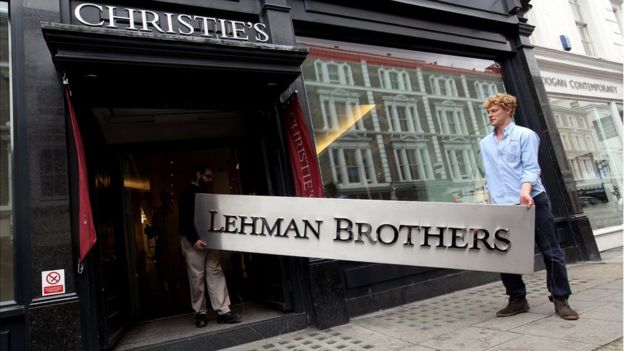

Currency traders say these moves are more extreme than those seen during the financial crisis of 2008.

"Never seen anything like it. These are once-in-a-lifetime moves, bigger than Lehmans and Black Wednesday," said Joe Rundle, head of trading at ETX Capital.

"We're waiting for the big money to crank into action over the coming days and even weeks, which will likely exert further downward pressure on sterling."

Around midnight, sterling had risen to $1.50 after leading Leave campaigner Nigel Farage said it looked as though Remain had "edged" the vote.

But those gains were short-lived as the first results showed surprisingly strong votes to leave the EU.

As for shares, the markets are pointing to a 8% slump when the FTSE 100 opens on Friday.

"The Bank of England is monitoring developments closely," the Bank said in a statement.

"It has undertaken extensive contingency planning and is working closely with HM Treasury, other domestic authorities and overseas central banks. The Bank of England will take all necessary steps to meet its responsibilities for monetary and financial stability."

'Nervous moves'

In Tokyo, the Nikkei 225 share index has fallen by more than 8%, with the yen up 5% as investors piled into the Japanese currency, which is seen as a safe haven.

The Bank of Japan (BoJ) said it stood ready to supply money to the markets if necessary.

"The BoJ, in close co-operation with relevant domestic and foreign authorities, will continue to carefully monitor how the [UK referendum] would affect global financial markets," the Bank's governor, Haruhiko Kuroda, said in a statement.

Japan's finance minister, Taro Aso, said he was ready to respond to movements on the currency market if necessary to prevent "extremely nervous moves".

A increase in the value of the Japanese yen hurts the country's exporting companies.

In commodities, the price of gold jumped nearly 7% to $1,348.27 an ounce.

Top four pound moves post-World War Two

- 1971 Pound moves 3.4% after Nixon Shock — cancellation of the direct international convertibility of the United States dollar to gold.

- 1 November 1978 4.3% "Winter of discontent" shakes global investors confidence in UK's economy.

- 16 September 1992 4.29% when the UK exited the exchange rate mechanism.

- 20 Jan 2009 Pound slides 3.9% at the peak of the financial crisis following the demise of Lehman Brothers.

Политика конфиденциальности | Правила пользования сайтом