Brexit BOOM: FTSE 100 leaps to HIGHEST level since 2011 just a week after EU referendum

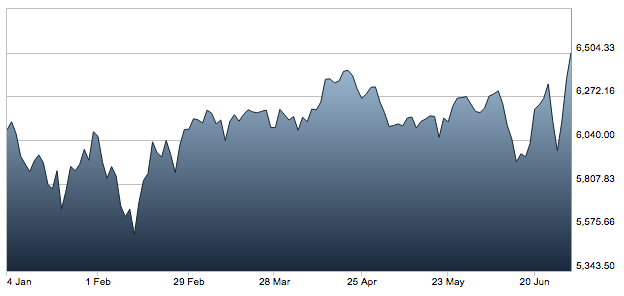

BRITAIN's top stock market has surged to its highest level in five years, just one week after the vote to leave the European Union (EU).

The FTSE 100 jumped again in Friday trading to sit at around 6,577 — its highest level since August 2015.

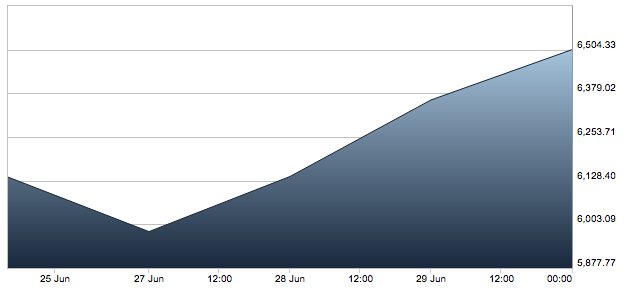

The index has been climbing since Tuesday as confidence recovered from the initial shock over the outcome of the referendum.

Despite experiencing one of the most volatile weeks since the 2008 financial crisis, the FTSE posted its best week since December 2, 2011, making gains of 7.15 per cent.

Bank of England Governor Mark Carney yesterday evening injected extra confidence into markets by promising Britain is tough enough to deal with the transition period of leaving the bloc.

The chief also heavily hinted interest rates are set to be cut in the next couple of months to provide extra stimulus to the economy.

The comments helped continue the rally that has taken hold since Tuesday and pushed the market far above its pre-referendum high of around 6,300.

It is now expected the Bank's base rate will be cut from 0.5 per cent to 0.25 per cent in August.

The prospect of a rate fall, however, has weakened the pound, which is now at 1.19 against the euro and 1.32 against the dollar.

Connor Campbell, financial analyst at Spreadex.com, said: "Markets are continuing their recovery this Friday, lifted by Mark Carney’s Thursday comments.

"Considering we are exactly a week on from the Brexit referendum, and subsequent market panic, the fact that the FTSE has climbed all the way above 6500 for the first time since last August is staggering.

"The index was propelled to this 10ish month high by the promise of stimulus, including a rate cut, from the Bank of England.

"Understandably this news wasn’t greeted with unanimous cheer; cable (the dollar/pound exchange), which had been teasing $1.35, plunged to $1.32 during Carney’s speech."

Политика конфиденциальности | Правила пользования сайтом